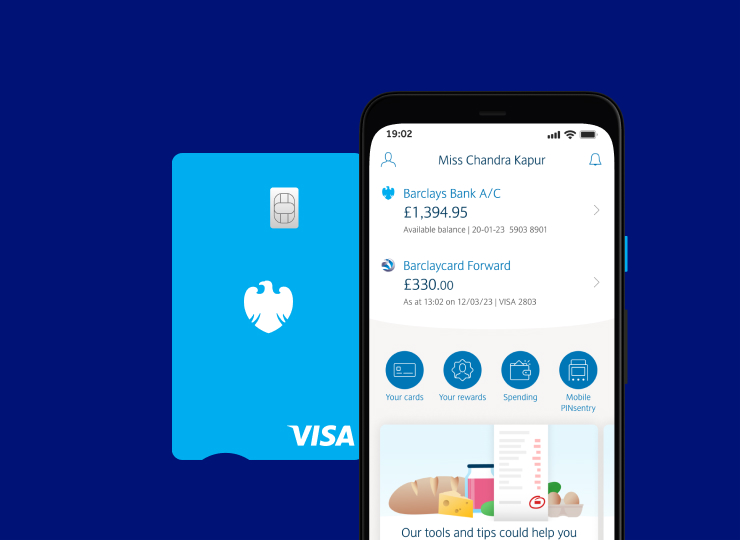

Everyday current accounts

Take a look at the benefits of the Barclays Bank Account – plus the extras you can get by joining Blue Rewards – and see the perks you can get with a Premier Current Account.

Explore the full details of our account options, including how to boost your Barclays Bank Account with Blue Rewards and the eligibility, terms and conditions for each account.

Select the <i icon> in the table to read important information about our current accounts and Blue Rewards.

Fees and eligibility

Fee

Eligibility

Eligibility

- Be 18 or over

- Be a UK resident

Eligibility

- Be 18 or over

- Be a UK resident

- Have at least £800 paid in to the account every month

- Be registered for the Barclays app

- Provide your email address.

Eligibility

- Be 18 or over

- Be a UK resident

- Pay in a gross annual income of at least £75,000, or have a total balance of at least £100,000 in savings with us, eligible investments, or a mix of both.

Eligible investments are Investment ISAs, SIPPs or General Investment Accounts held through Smart Investor, Plan and Invest or Barclays Investment Solutions Limited.

Personalised debit card

Apple Pay or Google Pay

Use your Apple or Android device to pay with your debit card wherever you see the Apple Pay, Google Pay or contactless logo.

Money management tools

See a breakdown of your spending, stay on track with savings goals and set up instant spending alerts to see when you spend or receive money.

Optional arranged overdraft

An arranged overdraft is a pre-agreed limit that lets you spend more money than you have in your current account. We charge you for every day of the month you use your arranged overdraft (beyond any interest-free limit you may have).

All overdrafts are subject to application, financial circumstances and borrowing history.

Reward Saver

Get rewarded with a higher interest rate of 2.75% AER/2.72% gross p.a. (variable) in months where you don’t dip into your savings and 1% AER/ gross p.a. (variable) in months with one or more withdrawals.

From 2nd December 2024 interest rates will be 2.75% AER/2.72% gross p.a. in months you don’t make withdrawals, 0.85% AER/gross p.a. in months you do make withdrawals.

Rainy Day Saver

Build an emergency fund and earn our highest instant-access savings rate of 5.12% AER/ 5% gross p.a. on balances from £1 to £5,000 – 1.16% AER/ 1.15% gross p.a. (variable) on balances over £5,000.

Rainy Day Saver

Build an emergency fund and earn our highest instant-access savings rate of 5.12% AER/ 5% gross p.a. on balances from £1 to £5,000 – 1.16% AER/ 1.15% gross p.a. (variable) on balances over £5,000.

Apple TV

Apple TV+ subscription, usually £8.99 a month, plus a Major League Soccer Season Pass subscription worth £14.99 a month during the season.

Cashback Rewards

Get up to 15% cashback when you spend at selected retailers with your linked Barclays Visa debit card. T&Cs apply.

Barclays Avios Rewards

Join Barclays Avios Rewards for £12 a month and collect Avios to put towards your next trip with British Airways. Eligibility and conditions apply.

Support

App and Online Banking(7)

Telephone Banking

Premier Financial Guides

Telephone Banking

We’re here to help Monday to Friday, 9am to 5pm. Call charges may apply.

Telephone Banking

We’re here to help Monday to Friday, 9am to 5pm. Call charges may apply.

Premier Telephone Banking

24/7 support, 365 days a year from our UK-based Premier Telephone Banking team.

Premier Financial Guides

24/7 support, 365 days a year from our UK-based Premier Telephone Banking team.

Student and graduate accounts

Student Additions Account

Get more from your everyday banking with our account designed for student life. Eligibility, terms and conditions apply.

Higher Education Account

Whether you’re looking to start your first job or travel the world, take the next step with this account – it’s available for three years after you graduate. Eligibility, terms and conditions apply.

Accounts for under 18s

Barclay Plus

Start your banking journey with our simple, secure account for 11 to 15 year olds. Eligibility, terms and conditions apply.

Young Person’s Account

Spend, save and learn more about money with our account for 16 to 17 year olds. Eligibility, terms and conditions apply.

More accounts

Foreign Currency Account

Make and receive foreign payments with our foreign currency accounts. Eligibility, terms & and conditions apply.

Barclays Basic Account

If you’re not eligible for our current accounts, don’t yet have a UK account, or you’re experiencing financial difficulties, a Barclays Basic Account could be right for you. Eligibility, terms & and conditions apply.

Important information

Google Pay and Google Wallet are trademarks of Google LLC.(Return to reference)

Subject to status and available funds. Individual cash machine limits may apply. You need to increase your cash machine withdrawal limit from £1,000 to £2,000 in the Barclays app.(Return to reference)

See our full range of savings products at barclays.co.uk/savings/#savings(Return to reference)

‘Gross’ is the rate payable without tax taken off. ‘AER’ (Annual Equivalent Rate) shows what the interest rate would be if interest was paid and compounded once each year. Interest is calculated daily using your statement balance and paid monthly on the first working day of the month.(Return to reference)

Barclays Cashback Rewards terms and conditions are separate from the Blue Rewards terms and conditions. Spend must be on the debit card nominated for your Blue Rewards account. To earn cashback, you'll need to follow the individual retailer offer terms.

(Return to reference)You can opt in to Barclays Avios Rewards if you're a Premier Banking customer or have a Wealth current account with us – you'll need to register for the Barclays app and have a British Airways Executive Club account too. There's a £12 monthly fee and you have to opt out of Barclays Blue Rewards and go paperless for all your accounts and services with us. To access Barclays Avios Rewards in the Barclays app, you need to be over 18. You can join Premier Banking if you have an income of £75,000 or £100,000 held with us. T&Cs apply.(Return to reference)

You need to be 18 or over to access this product or service using the app. T&Cs apply.(Return to reference)