The rising cost of living

With prices on the rise, we’re here to help you stay on top of your money, budget better and find ways to cut back and save.

Put what you owe in one place

If you have lots of debt in different places, it could be worth bringing it all together into one new outstanding balance - a consolidation loan.

This type of loan pays off your existing debt elsewhere – for example, a large overdraft, store and credit cards or other personal loans - and turns it into one new monthly payment.

A debt consolidation loan won’t reduce the amount that you owe, but it can help you to manage what you owe in a simpler way. However, if you can get a loan at a lower rate of interest than those on your previous debts, it could work out cheaper too. With rises in the cost of living, it can be difficult to stay on top of your debt. To work out if a debt consolidation loan could help you to look after your money, here are answers to some of the most common questions.

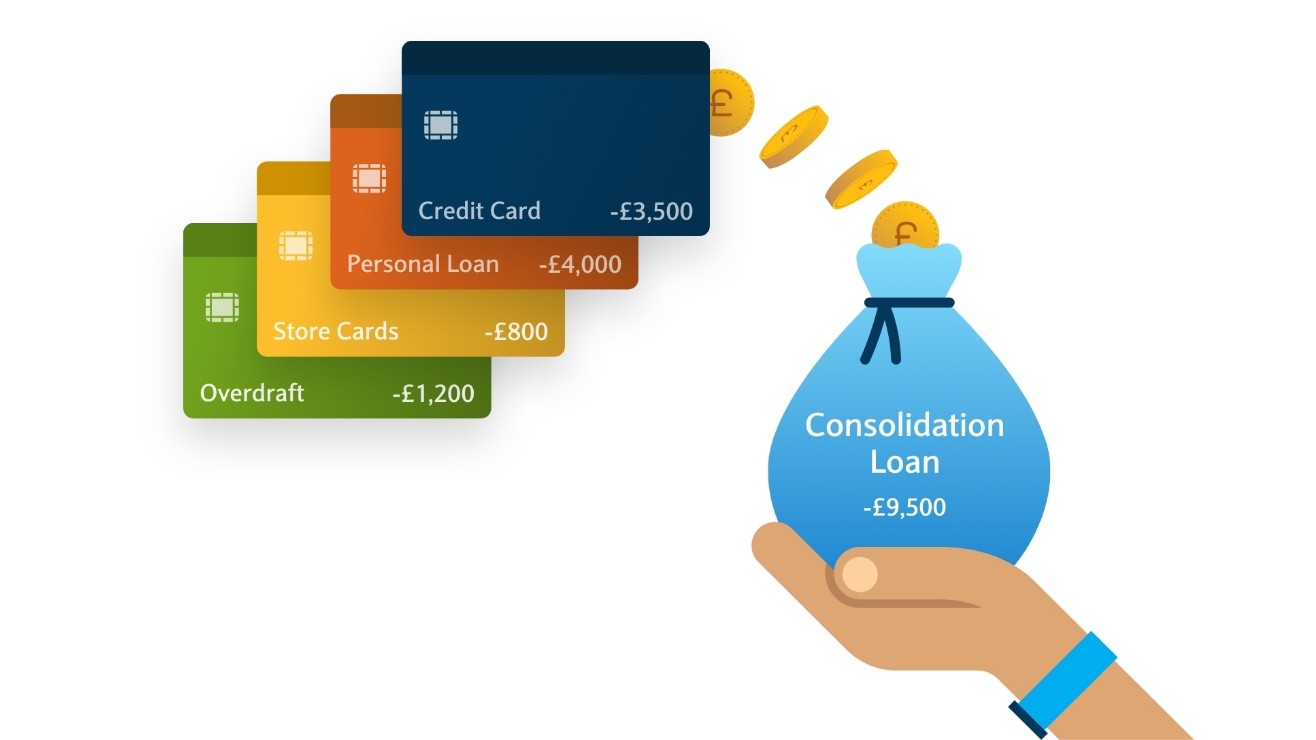

Imagine you owe money to four different lenders, and each debt has its own rate of interest.

They include a £1,200 overdraft, £3,500 credit card debt, £4,000 outstanding on a personal loan plus £800 on store cards.

Apply for a £9,500 consolidation loan and – if you’re successful - this money then pays all the old debts off. You then pay a single sum towards your new loan each month until all the debt is repaid.

A consolidation loan can make it simpler to look after what you owe. If you have a number of debts in different places, you may not feel as if you’re able to stay on top of your money.

In particular, it can be difficult if you’re juggling several outstanding sums of various sizes, with different interest rates and payment dates – and you’re not sure which to put as a priority.

With a single monthly payment to focus on, it can also help to focus your budgeting around one date in the calendar and reduce your overall risk of missing a repayment.

While a consolidation loan won’t reduce the amount of debt you owe, you could end up paying less interest if you’re eligible for a loan with a lower interest rate than you’re currently paying.

While a consolidation loan can bring all your debts into one place, there could also be higher costs to look out for.

It’s vital to take all these into account when working out if a consolidation loan could suit you.

For example, a debt consolidation loan might offer a lower interest rate than the ones on your current card and loan debts. However, the cost of an existing loan's exit penalty plus a longer period of repayment could mean much lower potential savings.

While a debt consolidation loan may be a better way to look after your debt, it’ll help your finances if you avoid using your old cards.

Having taken the step to simplify existing debts into one repayment, it should be easier to manage your money, see where your spending goes (and where you could cut back) and help with budgeting.

If you still need to use a credit card once you’ve consolidated the debt, try to keep new spending to an absolute minimum. Ask your lender to reduce your credit limit to help avoid building up further debt.

Yes. For most borrowers, a debt consolidation loan is like any other personal loan for a holiday, new car or extension: it’s ‘unsecured’, i.e. not linked to your home or any other asset. If you were to miss a payment, it could have an adverse impact on your credit score which can affect your ability to borrow in the future.

By comparison a ‘secured’ loan is like a second mortgage and is usually tied to your home. If you were to miss a number of payments in this scenario, it could leave you at risk of losing your property.

If you think debt consolidation could be an option to consider, you’ll find more information on our Barclayloan page and you can try out our debt consolidation loan calculator.

If you’re not sure, talk to an expert. They can help you go through the advantages and disadvantages, and may offer other options that you hadn’t yet considered.

You can call a free helpline such as the National Debtline on 0808 808 4000, or get in touch with the Citizens Advice Bureau.

With prices on the rise, we’re here to help you stay on top of your money, budget better and find ways to cut back and save.