What are savings goals and how do I create one?

Set, save and track

Set up a savings goal in the Barclays app and track your progress.

Whether you’re putting some money aside for a holiday, home improvements or a rainy day, setting a goal could help you reach your target faster. If you’ve already got a Help to Buy: ISA, Everyday Saver, Rainy Day Saver, Blue Rewards Saver, Rewards Saver, Reward ISA or Instant Cash ISA, you can link our ‘Savings goal’ feature to your savings account. If you don’t have one of these accounts yet, you can open one and then create your goal. For Help to Buy: ISAs, you’ll need to already have an account, as they’re closed for new savers. We’ve also got some savings tips to help you stay on track.

Set up a savings goal in the Barclays app

Set up your savings goal

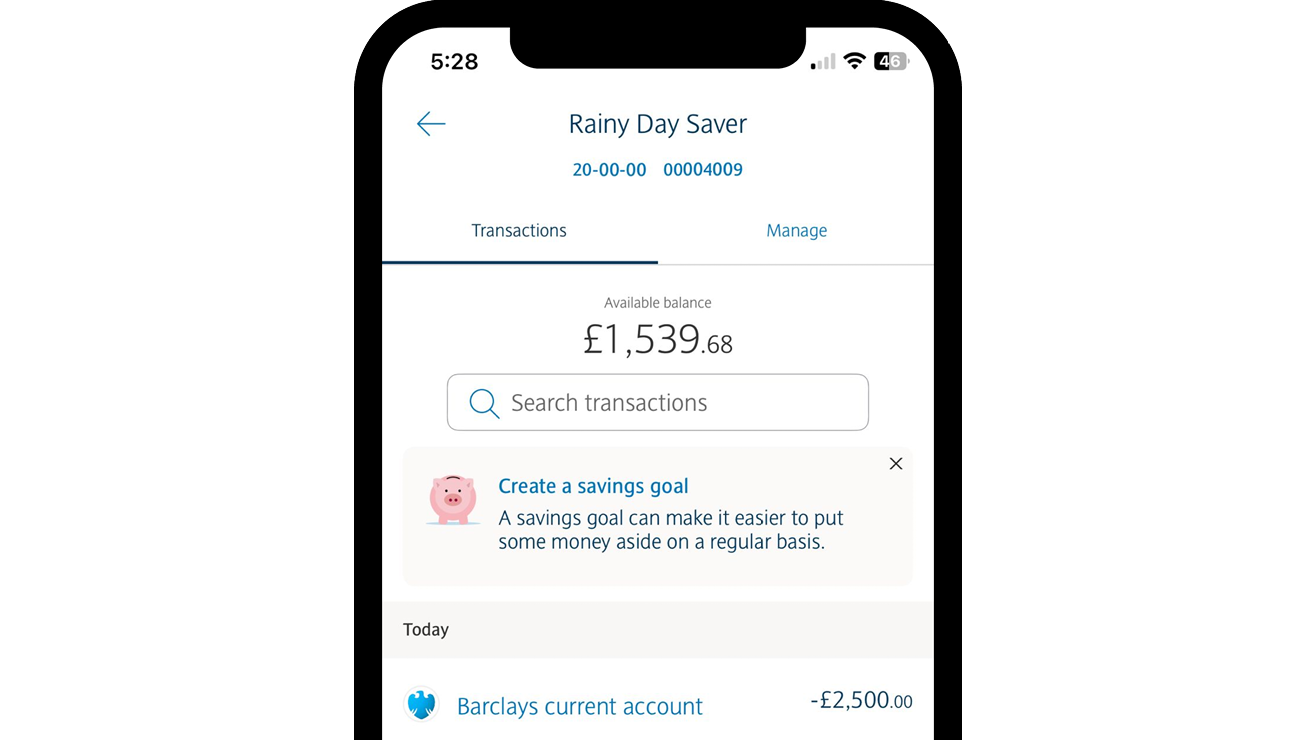

You can set up a savings goal for your Help to Buy: ISA, Everyday Saver, Rainy Day Saver, Blue Rewards Saver, Rewards Saver, Reward ISA or Instant Cash ISA in the Barclays app. Just log in and tap the ‘Create a savings goal’ banner on the account screen to get started. You can set up one goal for each of your sole savings accounts. If you don’t have one of these accounts yet, you can open one and then create your goal. For Help to Buy: ISAs, you’ll need to already have an account, as they’re closed for new savers. We’ve also got some savings tips to help you stay on track.

If you don’t have the app, you’ll need to download it and register first.

You must have a Barclays or Barclaycard account, have a mobile number and be aged 16 or over to use the Barclays app. Terms and conditions apply.

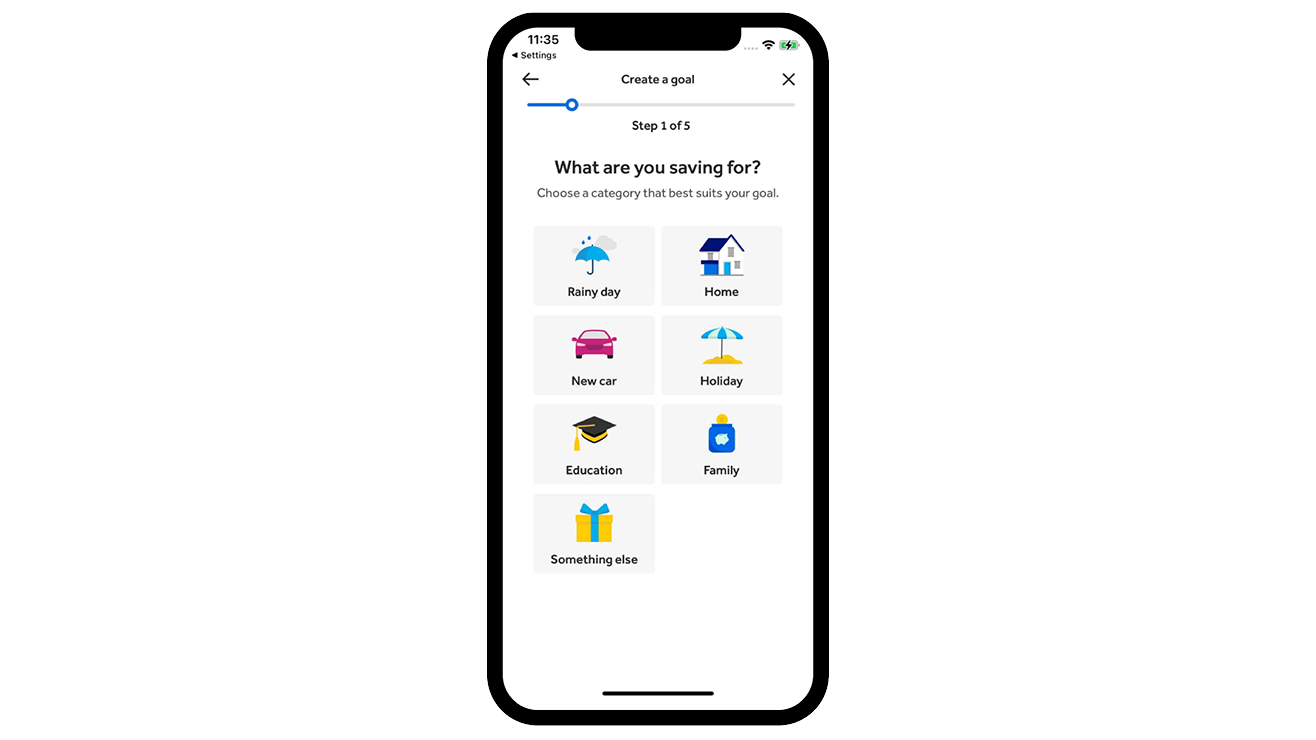

Get started in 5 steps

1. Choose a category

There’s a range of categories, such as ‘holiday’ or ‘home’. Choose the one that best suits your goal.

2. Name your goal

Giving your goal a name, like ‘Bali holiday’, can make it more meaningful for you. It’ll appear in your list of accounts when you log in to the Barclays app.

3. Choose a goal amount

Enter the amount you want to save.

4. Set a target date

Setting a target date is optional, but it can help you work out how much you’ll need to save on a daily, weekly or monthly basis to reach your goal.

5. Review your goal

See a summary of your goal amount, target date (if set), and a weekly and monthly breakdown of how much you’ll need to save.

That’s it – you’re ready to start saving.

Track your progress

Once you’ve set up your goal, use our personalised tracker to monitor your progress – if you’ve set a target date, you can see how much you’ve saved and how long you’ve got left to reach your savings goal. Just click on the account your goal is linked to and you'll see the tracker. If you need to change your goal, you can easily update the amount, target date or even delete it if you no longer need it.

Watch our video for a step-by-step guide to creating and managing your savings goals

How to stay on track

Need a little help to reach your savings goal? We’ve got some tips that could help.

Set simple milestones

Saving up enough money for a house deposit or large purchase could be easier if you break it up into smaller targets. Think of them as milestones on the way to your goal. You can also set up a regular payment to your account, so you don’t have to think about topping up your savings.

Stay focused

It takes a fair bit of motivation to regularly save money. So help yourself out by writing down your goals and putting them somewhere you’ll see them often. Also make sure your goals are realistic for the amount of money you have left after essential spending – we've got tips, tools and guides below that could help.

Treat yourself

Saving up for something usually means cutting back your spending on non-essentials. While you want to stay disciplined, it’s important to have some fun and treat yourself for sticking to your savings plan.

Make changes to your account

You can name each of your accounts to match whatever you’re saving for. You can also hide your accounts to stop yourself feeling tempted to spend or switch to a suitable account that limits your access.

Other things you may be interested in

14 top saving tips

Reboot, recharge and get your finances into shape. We’ve put together fourteen personal finance hacks – savvy shortcuts to bolster your bank balance1.

Important information

-

This article isn’t providing financial advice – if you need help getting your household finances in shape, get in touch with an expert. The Financial Conduct Authority provides tips on how to find a qualified independent financial adviser.Return to reference